Top Guidelines Of Personal Loans copyright

Top Guidelines Of Personal Loans copyright

Blog Article

The Facts About Personal Loans copyright Revealed

Table of ContentsThe Facts About Personal Loans copyright RevealedSome Of Personal Loans copyrightThe Buzz on Personal Loans copyright10 Easy Facts About Personal Loans copyright DescribedSee This Report on Personal Loans copyright

Allow's dive right into what an individual funding in fact is (and what it's not), the factors people use them, and exactly how you can cover those crazy emergency situation expenditures without tackling the burden of financial obligation. An individual finance is a round figure of cash you can obtain for. well, practically anything., yet that's technically not a personal car loan (Personal Loans copyright). Personal fundings are made with a real financial institutionlike a financial institution, credit report union or on the internet lender.

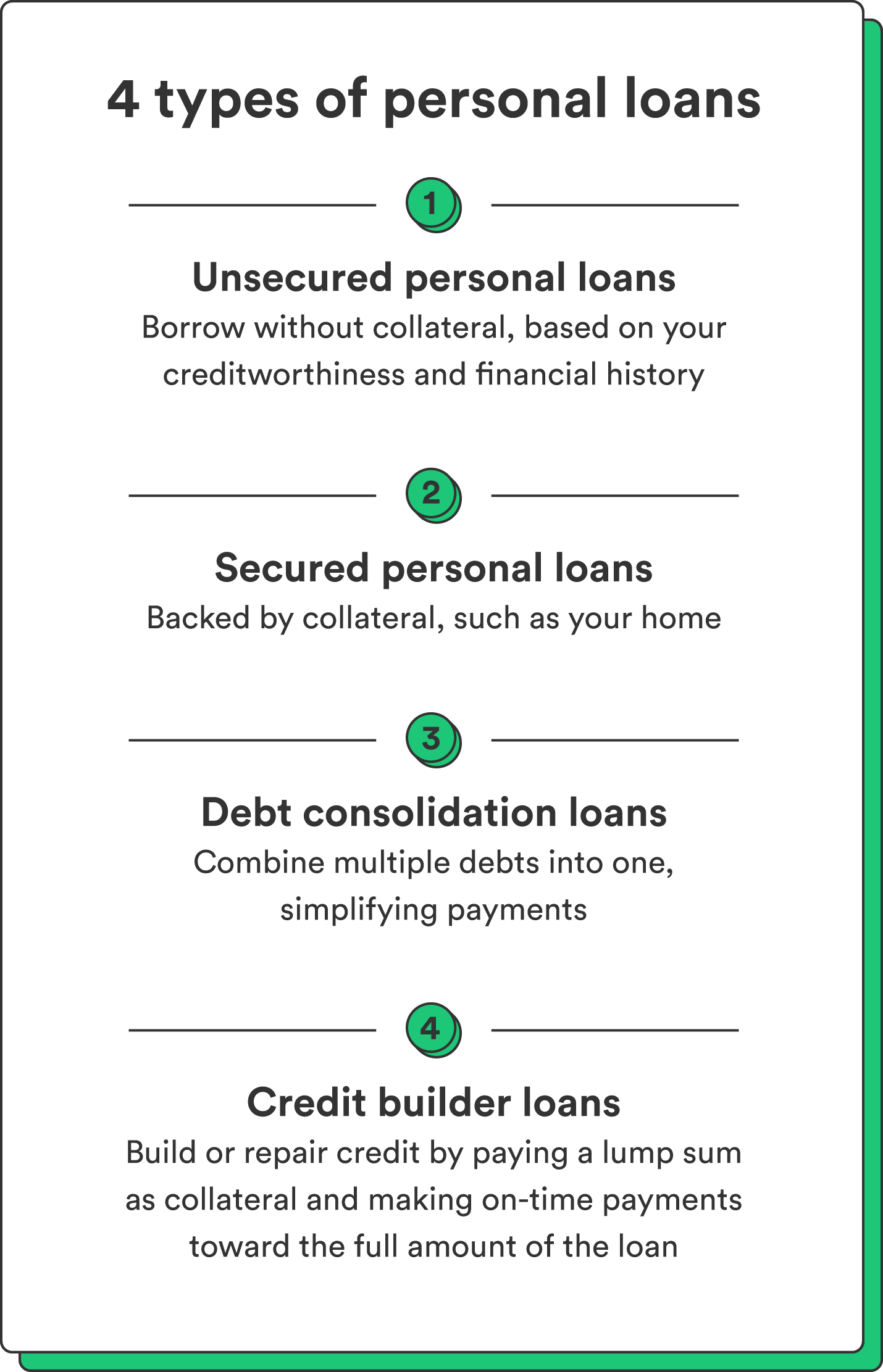

Allow's take a look at each so you can recognize exactly just how they workand why you do not need one. Ever before.

Unknown Facts About Personal Loans copyright

No matter exactly how good your credit history is, you'll still have to pay rate of interest on a lot of personal finances. Guaranteed individual loans, on the various other hand, have some type of security to "protect" the funding, like a watercraft, precious jewelry or RVjust to call a few.

You can likewise take out a secured individual finance using your car as security. Depend on us, there's absolutely nothing safe and secure regarding protected lendings.

Yet just because the settlements are predictable, it does not mean this is an excellent deal. Like we said previously, you're practically ensured to pay interest on a personal funding. Just do the math: You'll finish up paying way a lot more over time by getting a car loan than if you would certainly just paid with money

The Definitive Guide for Personal Loans copyright

And you're the fish holding on a line. An installment loan is a personal finance you pay back in repaired installations gradually (usually once a month) up until it's paid in complete - Personal Loans copyright. And do not miss this: You have to pay back the original finance amount prior to you can obtain anything else

Don't be mistaken: This isn't the same as a credit score card. With line of credits, you're paying rate of interest on the loaneven if you pay on time. This kind of car loan is incredibly complicated due to the fact that it makes you assume you're handling your financial obligation, when actually, it's handling you. Payday advance.

This one gets us riled up. Why? Due to the fact that these organizations prey on people that can not pay their costs. And that's just wrong. Technically, these are short-term finances that provide you your paycheck in development. That may sound enthusiastic when you remain in a monetary accident and need some cash to cover your bills.

The 10-Second Trick For Personal Loans copyright

Why? Due to the fact that things obtain real untidy real fast when you miss out on a payment. Those lenders will certainly come after your pleasant grandmother who guaranteed the financing for you. Oh, and you must never ever cosign a loan for any individual else either! Not just can you get stuck to a lending that was never ever meant to be yours in the initial place, but it'll wreck the relationship prior to you can claim "pay up." Count home on us, you do not wish to be on either side of this sticky circumstance.

All you're actually doing is utilizing new financial obligation to pay off old financial obligation (and extending your car loan term). Companies know that toowhich is specifically why so many of them offer you consolidation lendings.

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg)

And it starts with not borrowing any kind of more money. ever before. This is a good regulation of thumb for any type of monetary purchase. Whether you're thinking of getting this content a personal car loan to cover that kitchen area remodel or your my company overwhelming bank card costs. don't. Taking out financial debt to spend for things isn't the way to go.

Getting My Personal Loans copyright To Work

The very best thing you can do for your monetary future is leave that buy-now-pay-later attitude and say no to those investing impulses. And if you're thinking about an individual funding to cover an emergency situation, we get it. Borrowing money to pay for an emergency only intensifies the stress and anxiety and hardship of the circumstance.

Report this page